On the surface, the customer acquisition cost is a pretty neat and straightforward concept. Essentially, it’s a metric designed to help you understand how much you’re spending for each customer you bring into your business. It’s also a pretty essential metric: after all, how do you know you’re not spending too much on acquiring customers? And how do you actually know your marketing strategies are working?

In-depth, however, customer acquisition cost (CAC) is a bit more complicated than a simple formula -- particularly when it comes to B2B SaaS customer acquisition cost. It’s not an unsolvable enigma, though -- but definitely a challenge your SaaS should approach fully aware of what it means (and how it can be overcome).

Curious to learn more about CAC and how to use the customer acquisition cost formula correctly in a SaaS business?

Read on to find out more.

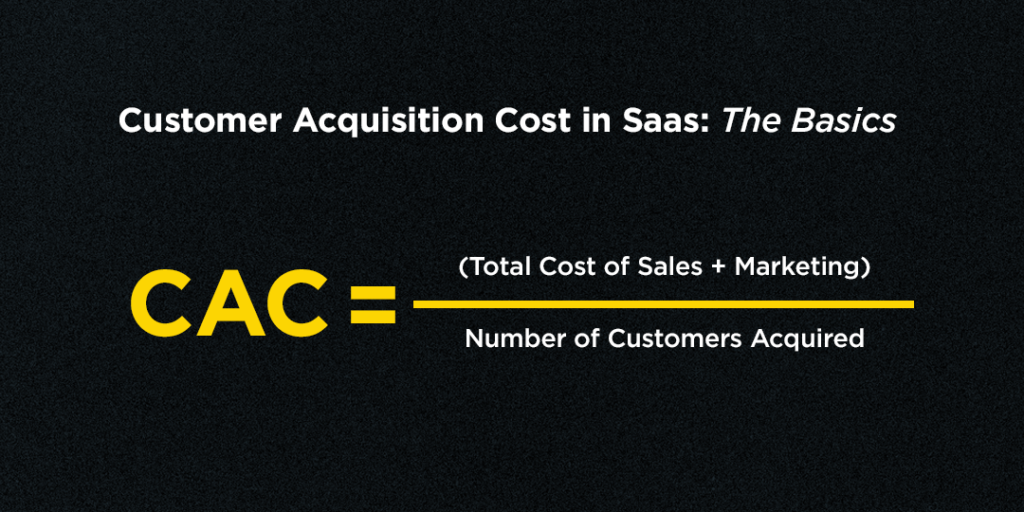

Customer Acquisition Cost is easy math, but absolutely crucial to the success of pretty much every business under the Sun (be it B2B or B2C, SaaS or not). In essence, to find out your CAC, you should round up all your marketing and sales expenses that go into acquiring customers over a given period of time and divide it by the number of customers you got in said period of time.

Let’s say your total marketing and sales expenses for getting 500 customers in one month are $1,500. That means your monthly CAC will be 1,500 / 500, which is 3. In other words, it costs you $3 to get each customer to buy from you.

In more mathematical terms, this is the Customer Acquisition Cost Formula for SaaS businesses (and not only) is this:

CAC = Total Cost of Sales & Marketing / Number of Customers Acquired

Unfortunately, simply calculating your CAC is not enough for a SaaS business. It is most definitely crucial, but if you want to use this metric to grow your business, you should also consider another metric: LTV (lifetime value).

LTV is defined as the total monetary value you’re likely to get from a buyer over the course of their “life” as your customer. For instance, in a SaaS business, a customer may stay with you for six months before they drop. If your monthly subscription is $40, that means the LTV will be $240.

That’s in a scenario where you only have one customer.

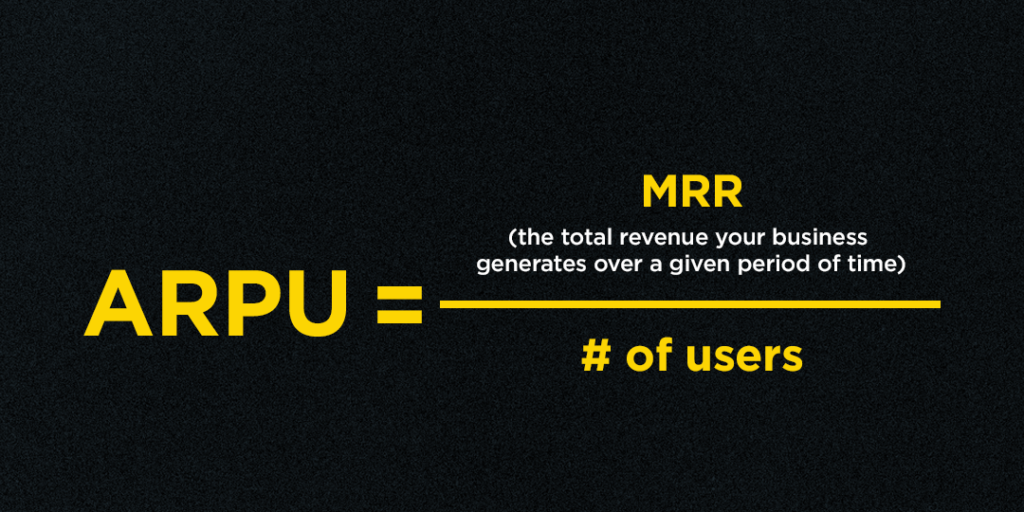

Most SaaS businesses have (thankfully!) more than one customer. That means that the LTV calculation gets a little more complex because you have to account for all the values all your customers bring into the business. To do that, you have to calculate an Average Revenue Per User (ARPU), which is done by dividing your MRR (the total revenue your business generates over a given period of time) by the total number of users your business has.

ARPU = MRR/ # of users

For instance, if you have a total of 100 customers and you made $2000 from all of them throughout 2020, then your yearly ARPU will be $20.

Churn rate is another metric you need to have in handy when you calculate your LTV. To calculate your churn rate, look at the number of customers you have to follow this formula:

Churn rate = (number of customers at the beginning of the month - number of customers at the end of the month) / number of customers at the beginning of the month X 100.

So, for example, if you have 100 customers at the beginning of December and by the end of the month you are left with 90, your churn rate will be (100 - 90)/ 100 X 100 = 10 (%).

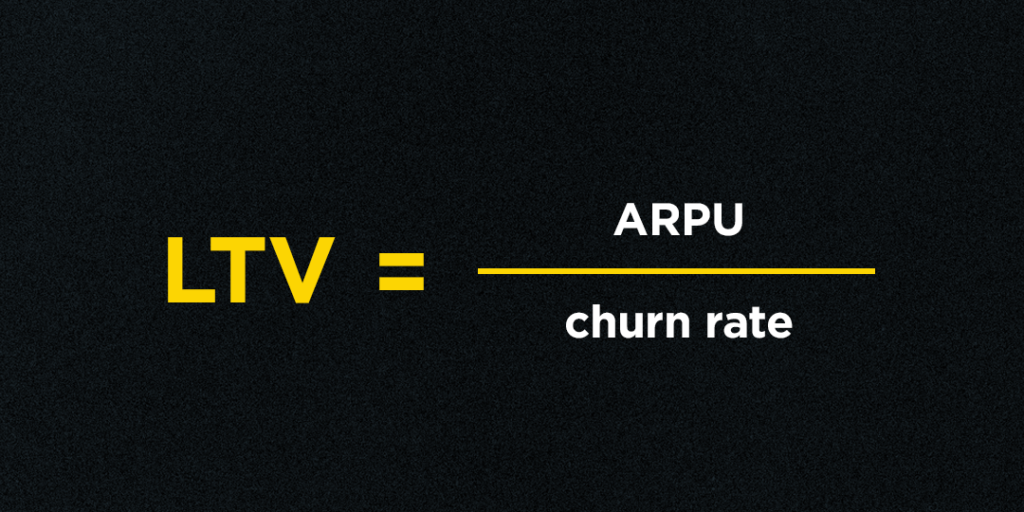

Both ARPU and the churn rate are essential in calculating Lifetime Value. To do this (taking both ARPU and churn rate into consideration), you should divide your ARPU by your churn rate.

LTV = ARPU/ churn rate

This means that in the aforementioned scenario, your LTV would be 20/10 = $10.

To circle back to Customer Acquisition Cost, your LTV and your CAC are very tightly connected. If your CAC is low and your LTV is also low, you’re basically in trouble. In a wordy translation, it would mean that you spend little to acquire customers, but they don’t stick with you for long enough for even a low CAC to make it worth the effort.

CAC and LTV should always be in balance because you want people to not only come through your SaaS business’ virtual doors but also stay a while with you and come back month after month.

In many ways, the CAC/ LTV ratio is one of the single most important metrics every SaaS business should keep in mind. The nature of Software as Service business models implies that the enterprise is getting its revenues on a month-by-month basis -- so it is essential that all their sales and marketing efforts cost just enough to attract long-term prospects, rather than one-offs that will churn quickly (and thus leave the lifetime CAC in the dark).

OK, now that we’ve figured out why B2B SaaS Customer Acquisition Cost and Lifetime Value are so connected (and so important!), let’s take a look at another common question SaaS businesses have when it comes to CAC: what exactly should you include as “Sales & Marketing” expenses when you calculate acquisition cost per customer?

Well, as disappointing as this may seem, the answer is not that simple. People have endless debates on what exactly should be included as an expense. However, the basic rule is to include the “holy trifecta” of every functional Sales & Marketing joint effort:

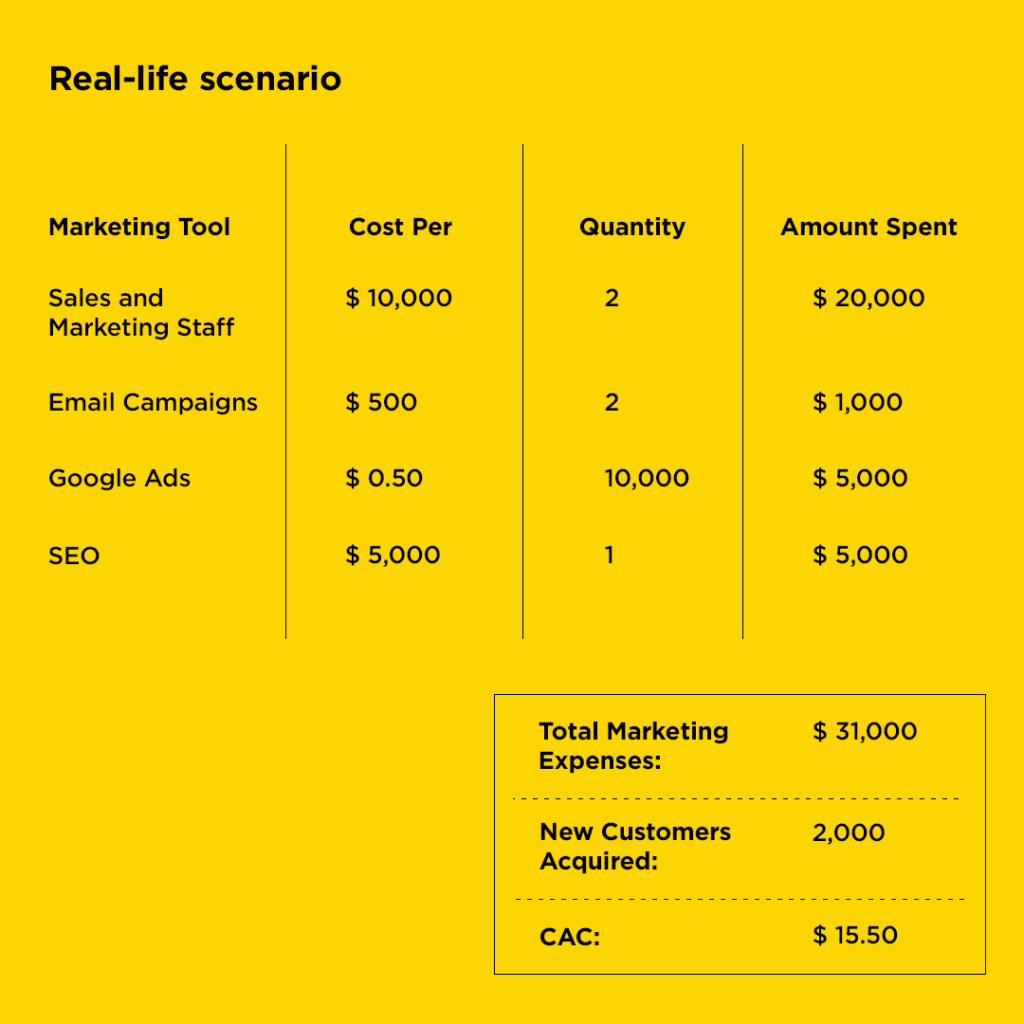

Let’s run a little example to show you how this would look like in a real-life scenario:

To go back to the LTV discussion a little, in this scenario, let’s say that your new customers (and I emphasize “new” because you should only consider those for these calculations) churn at a rate of 10% per month, but provide you with an ARPU of $12,000. That means your LTV is $120.

Furthermore, keep in mind that in some cases, your CAC may temporarily be very high, but when put in comparison with your LTV, you might notice that you are actually spending just the right amount for the money your customers are bringing into your business.

As a last note, also bear in mind that Customer Success is not usually included as a Sales & Marketing expense. This is a long-winded debate as well, but as a general rule, you don’t want to include Customer Success in this category of expenses because CS is usually connected to retention, rather than customer acquisition.

So, how do you know if your CAC is good?

Aside from the fact that CAC and LTV should be revealing enough to show you whether you’re spending too much (and getting too little in return), you might also want to consider the different average Customer Acquisition Cost for B2B businesses and compare.

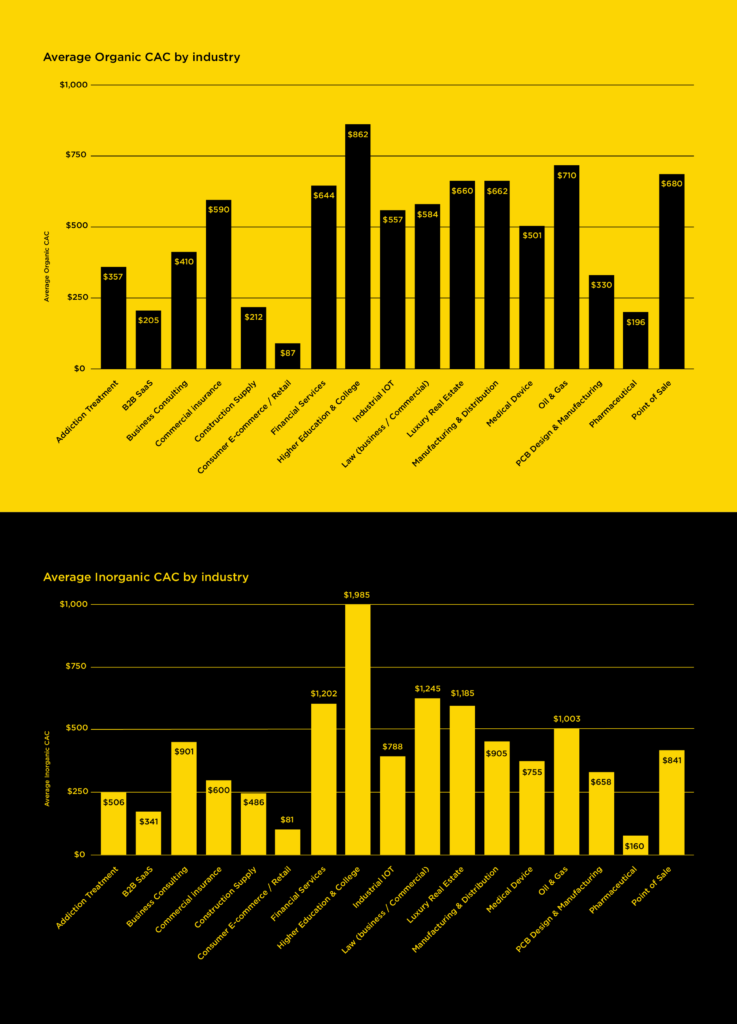

Average CAC can be wildly different, with the highest rates being recorded in industries like Higher Education and Luxury Retail, where the average CAC can easily move past the $1,000 and even north of $2,000 marks.

For a B2B SaaS, the average organic CAC is around $200 and the average inorganic CAC is around $340 (where organic refers to acquisition strategies revolving around SEO, email, and other organic sources, whereas inorganic refers to paid advertising and other paid acquisition channels).

Here’s a more detailed overview of the average B2B Customer Acquisition Cost in 2020:

At this point, you might think “OK, OK, all this is pretty neat and interesting, but why exactly is calculating my Customer Acquisition Cost so important?”

Well, the main reasons your CAC is a driving force behind business growth include the following:

You now know why your Customer Acquisition Cost (and all the other metrics associated with it) is important. You also know how to calculate your CAC for a SaaS B2B business.

How about improving it? How do you make sure your B2B SaaS CAC is in a good area?

Work on, optimize, and fine-tune your Sales & Marketing funnel. At the end of the day, how your customers become customers is all about the journey you “show” them. Optimizing your funnel helps you make sure as many users as possible eventually become your customers.

Put money in the right channels. In other words, invest in those sales/ marketing channels that show results for you. No two businesses are alike, not even when they are both active in the B2B space, so experimenting and measuring is the only way to find out what works for you.

Be thorough when strategizing your pricing strategy. This kind of comes without saying, but a good pricing strategy will always help you recover your CAC. That doesn’t mean you should just push your prices up, but that you should search for those specific gates that enable you to acquire customers on all packages and levels your SaaS business offers, provide them with genuine value, and make a profit in the process.

Engage new customers and prospects ASAP. The sooner you draw them in, the more likely it is that they will become customers (if they are prospects) and that they will also be retained (if they are customers).

I know Customer Acquisition Cost can be a staggeringly complex topic -- but as shown and reiterated in this article, it is an essential element to SaaS B2B success. Whether you decide to put more money into PPC, content, SEO, email, or any other inbound or outbound marketing channel is all up to you and your specific experience and results with each of these channels. At the end of the day, numbers speak louder than words, and CAC is precisely the kind of metric you want to look at when you analyze your Marketing & Sales efforts.

Are you ready then to lower your Customer Acquisition Cost, improve your Conversion Rate, and create loyal customers? Schedule a free SEO discovery session and find out how you can improve your organic visibility and reach more customers.